Build a great real estate portfolio today

Introducing the first real estate crowd-investment platform for Saudi Arabia.

Explore Opportunities

Investment Opportunities

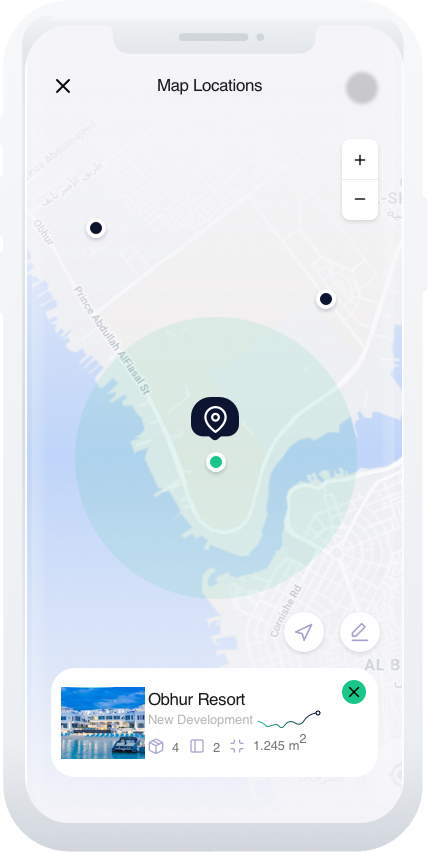

With IQARI, you can invest in a low-cost, diversified portfolio of institutional-quality real estate. We combine state-of-the-art technology with in-house expertise to reduce fees and maximize your long-term return potential.

Flexible Investing

Unlike most private real estate investments, our low minimums give you the flexibility to invest the right amount, at the right time, to meet your goals

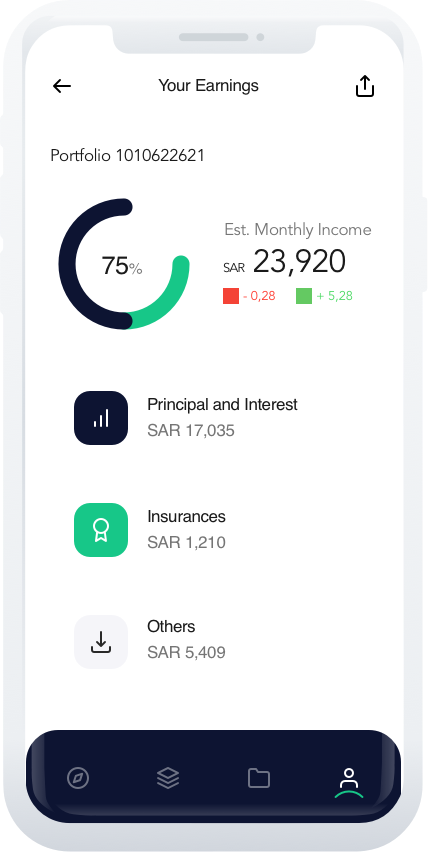

Earn Income up to 10 - 15 % per year

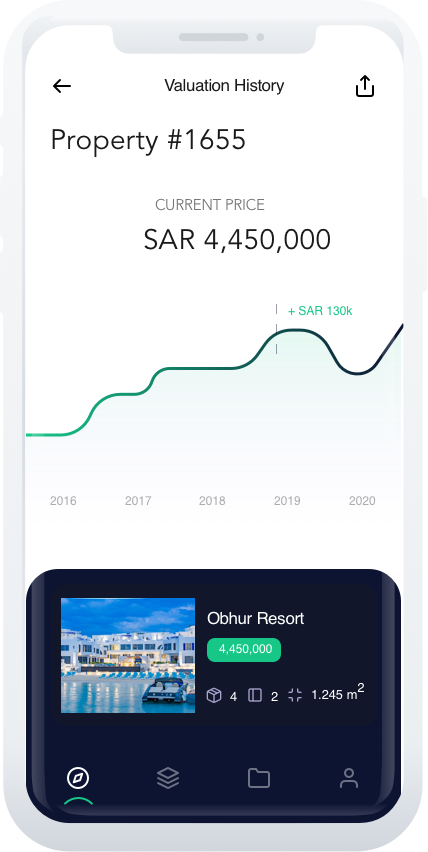

We offer both residental and commercial rental properties. Track your performance and watch as properties across the country are acquired, improved, and operated via dynamic asset updates.

Diverse Opportunities

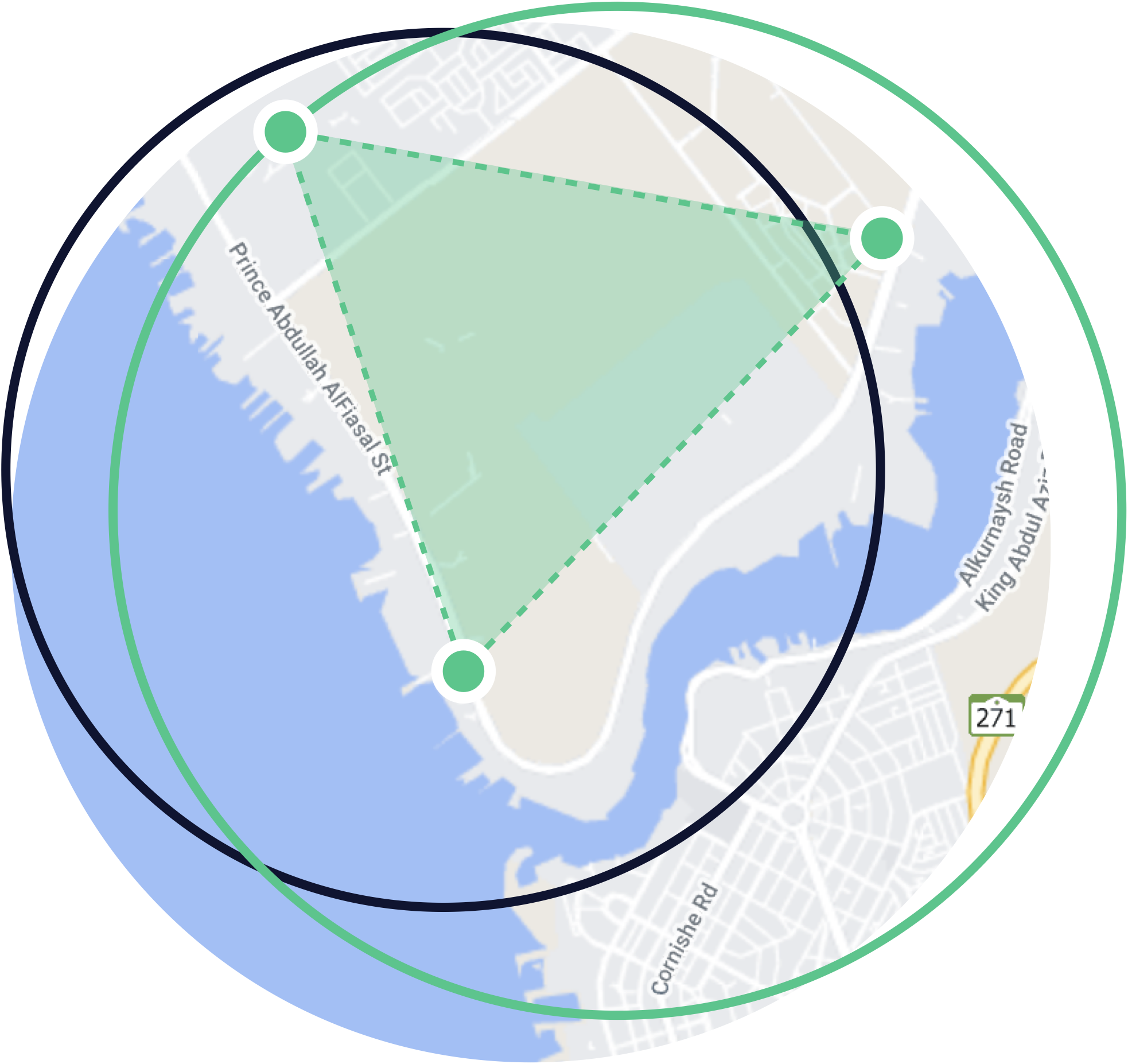

Now you can diversify outside of the public markets with private real estate, allowing you to reduce risk and improve stability.

Our Mobile Apps Coming Soon

How It Works

Your portfolio is powered by high-quality, resilient assets.

Our assets drive your returns. We pair our extensive network and expertise with the collective buying power of our investor community to acquire high-quality assets ranging from debt to equity, commercial to residential, and more. We follow a "value investing" strategy of acquiring assets for less than what we believe is their intrinsic value, and typically less than their replacement cost. Our team then works to increase the value of each asset over time through hands-on management and in partnership with local operators.

Your returns are maximized through our low-fee approach.

While historically profitable, the real estate investing industry is notorious for its high advisory fees, hidden management fees, and return-limiting performance fees. Fundrise investors are arguably able to own real property in a more low-cost way than was previously ever possible. We've reduced our costs and your fees to ensure you keep more of what you earn. We did this by designing new software that makes dozens of expensive-but-required processes much cheaper at scale.

Your first investment is just the beginning.

Within minutes, you can create an account, choose your portfolio strategy, and watch as your dollars are diversified across a series of investment funds tailored to your selected strategy. After you place your initial investment, we'll keep working to find and add new assets to your portfolio over time — with no additional investment required on your end. This means your already-diversified portfolio can become stronger year after year.

Our Process

Inbound

Sorting through inbound proposals within our target markets.

Analysis

Analyzing every deal according to our pipeline fund requirements.

Due Diligence

Researching property details and local realtor opinions on future trends.

Negotiation

Negotiating terms with the developer, realtor and property manager.

Financing

Crowd sourcing the investment through Iqari.

Liquidation

Reselling the asset after a successful holding period.

RISK WARNING

The competent finance team at IQARI evaluates the credentials of each business before finalizing a user agreement. As a buyer-centric entity, IQARI adheres to a set of compliance practices and mechanisms to ensure that only authentic listings are featured on the platform for funding purposes. Nonetheless, it is imperative for investors to understand that they are lending to SMEs which maybe at the early-stages of establishing their presence in the industry. Therefore, the level of risk associated with such investments is higher which could also result in a potential loss and delays in repayment. It is necessary to understand that you could lose your money.